|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

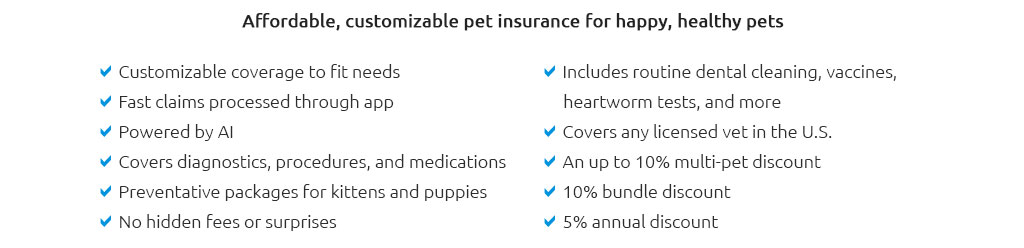

dog insurance medical choices that balance care and costHealthy today, unpredictable tomorrow. Veterinary care saves lives; the invoices can sting. Dog insurance medical coverage turns large, sudden expenses into planned, fair costs - ideally without surprises. What it covers and how it worksMost policies refund a portion of eligible vet bills after you meet a deductible. You choose the deductible, reimbursement rate, and annual limit; those choices set your premium and your comfort level.

Claims usually process digitally. The clearer your medical records and invoices, the smoother the outcome. Fairness starts with the fine printFairness isn't only about price; it's about terms you can understand and trust. Watch for waiting periods, bilateral condition clauses, dental trauma limits, and how a company defines "pre-existing." Transparent policies put the definitions up front and honor them consistently. Some folks say a cash cushion beats insurance for a young, healthy dog; I gently see the point, yet lean the other way because a single emergency can outpace savings. Either path can be fair - if you set clear limits and stick to them. Savings, without cutting cornersYou're trading a known monthly premium for protection against rare, expensive moments. Example math: cruciate surgery at $3,500 with an 80% reimbursement and a $500 deductible means you'd pay $500 + 20% of the remainder - about $1,200 - saving roughly $2,300 while keeping access to quality care.

Decision timingEnroll before problems arise; coverage rarely backdates. Puppies get better rates and fewer exclusions; seniors may benefit from accident-only or higher deductibles. Waiting periods start the clock, and deductibles typically reset each policy year - renewal timing can influence what you pay. A real Tuesday nightAt 11:30 p.m., my terrier swallowed a peach pit. Emergency x-ray, endoscopy, monitoring - $1,420. The claim paid 80% five days later. The real relief wasn't just the reimbursement; it was deciding on care quickly, not haggling with myself about money. Coverage types to consider

What to compare before you choose

Quick steps to decide now

Buying early can feel premature, yet it's when terms are kindest and savings most likely. If the budget is tight, accident-only is a fair bridge; revisit illness coverage in six months. The goal is simple: protect your dog's care and your wallet with a policy that treats both with respect.

|